As the demand for electric vehicles (EVs) continues to grow, many car buyers wonder which electric vehicles still qualify for US federal tax credit. The federal tax credit is a potential incentive for purchasing an EV, as it can significantly reduce the overall cost of the vehicle.

Here, we’ll provide an in-depth look at the federal tax credit for electric vehicles, including which vehicles are eligible, how much the credit is worth, and what other government incentives are available for EV buyers. Whether you’re actively shopping for an EV or want to stay informed on the latest incentives, this post has you covered.

What is the Federal Tax Credit for Electric Vehicles?

The federal tax credit is a financial incentive offered by the US government to encourage the purchase of electric vehicles. It is available to buyers of new electric vehicles purchased in the United States. It can be applied to the buyer’s federal income taxes and is worth a specific dollar amount, depending on the make and model of the vehicle.

To qualify for the credit, the electric vehicle must be purchased new and used primarily for personal purposes. The credit is not available for leased vehicles or business purposes. In addition, the credit is only available for vehicles designed to be propelled primarily by an electric motor that draws electricity from a battery pack.

Now, let’s talk about the federal plug in hybrid tax credit. Those hybrid vehicles with a gasoline engine and an electric motor may also be eligible for the credit if they meet specific requirements.

It’s also important to note that the federal tax credit is being phased out for certain manufacturers. Once a manufacturer has sold 200,000 eligible electric vehicles, the credit begins to phase out for that manufacturer’s vehicles.

How Much is the Federal Tax Credit for Electric Vehicles?

The federal electric vehicle tax credit is worth a specific dollar amount, depending on the make and model of the vehicle. It can be applied to the buyer’s federal income taxes and is intended to encourage the purchase of electric vehicles by reducing their overall cost. Depending on the vehicle’s make and model, the credit amount varies.

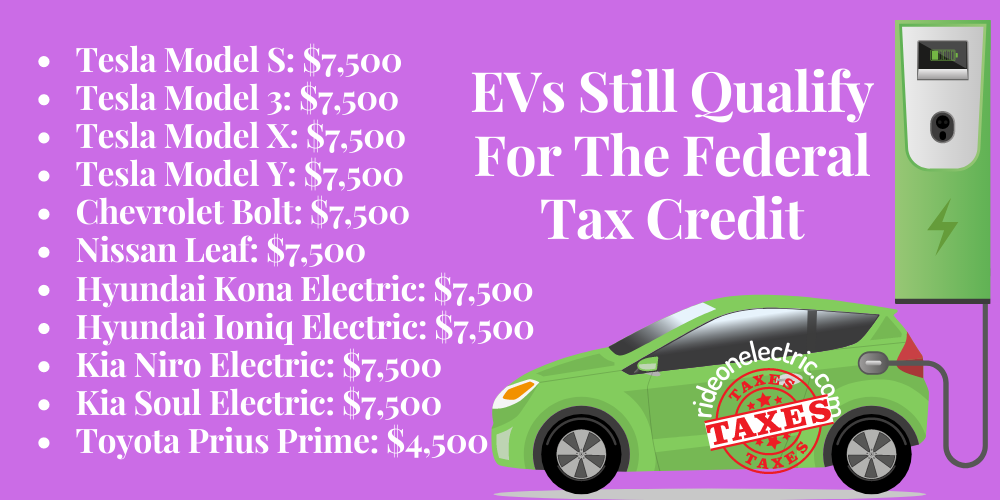

Similarly, the credit for a Chevrolet Bolt is $7,500, while the credit for a Toyota Prius Prime is $4,500. These amounts may change in the future, so it’s essential to check the most up-to-date information when considering the purchase of an electric vehicle.

It’s also important to note that the federal tax credit is being phased out for certain manufacturers. In addition to the federal EV tax credit update, other financial incentives may be available for electric vehicle buyers, depending on their location and circumstances.

Some states and localities offer rebates or tax credits for electric vehicle purchases, and there may also be incentives for installing charging infrastructure at your home or place of business.

Which EVs Still Qualify for the Federal Tax Credit?

Following electric vehicles still, qualify for the federal tax credit for electric cars 2023:

- Tesla Model S: $7,500

- Tesla Model 3: $7,500

- Tesla Model X: $7,500

- Tesla Model Y: $7,500

- Chevrolet Bolt: $7,500

- Nissan Leaf: $7,500

- Hyundai Kona Electric: $7,500

- Hyundai Ioniq Electric: $7,500

- Kia Niro Electric: $7,500

- Kia Soul Electric: $7,500

- Toyota Prius Prime: $4,500

It’s important to note that the federal tax credit is being phased out for certain manufacturers. Once a manufacturer has sold 200,000 eligible electric vehicles, the credit begins to phase out for that manufacturer’s vehicles.

In addition to the federal tax credit, other financial incentives may be available for electric vehicle buyers, depending on their location and circumstances. Some states and localities offer rebates or tax credits for electric vehicle purchases, and there may also be incentives for installing charging infrastructure at your home or place of business.

Government Incentives for EVs

Several government incentives for electric vehicles are available to encourage the purchase and use of electric vehicles. A rebate tax credit or a grant for charging infrastructure may be offered at the federal, state, or local levels.

One example of a federal incentive is the Alternative Fuel Infrastructure Tax Credit, which allows businesses to claim a tax credit for 30% of the cost of installing alternative fuel infrastructure, such as electric vehicle charging stations. This credit is available through 2021.

At the state and local levels, there may be a range of incentives available for electric vehicle buyers. These can include rebates, tax credits, and other financial incentives. Other states and localities may offer similar incentives, so it’s worth checking what’s available in your area.

In addition to financial incentives, non-financial incentives may be available for electric vehicle owners, such as access to high-occupancy vehicle lanes, discounted parking, and waived tolls. This federal rebate for electric vehicles and incentives are designed to encourage the use of EVs and can make driving an EV more convenient and cost-effective.

No, the federal tax credit is only available for new electric vehicles that are purchased, not leased.

Furthermore, we have discussed rebates, tax credits, and grants for charging infrastructure for electric vehicles. When considering an electric vehicle, it’s essential to research all available incentives, including which electric vehicles still qualify for US federal tax credit, and make an informed decision based on your individual needs and circumstances.